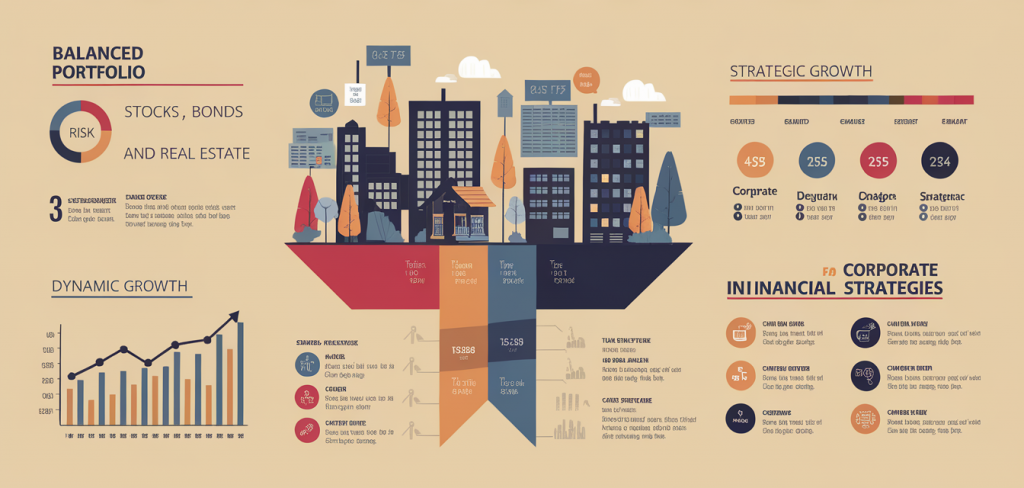

Understanding asset allocation models is essential for businesses, particularly when it comes to managing investments effectively. But what exactly is asset allocation? Think of it as the recipe for your financial dish. Just as a chef combines different ingredients to create a flavorful meal, investors mix various asset classes—like stocks, bonds, and real estate—to achieve optimal portfolio growth.

First, let’s explore the core types of asset allocation. Central to business investment strategies, there are three primary models you should become familiar with: strategic, tactical, and dynamic asset allocation.

Strategic asset allocation is the long-term approach, setting a target mix based on your company’s financial goals and risk tolerance. Imagine setting the foundation for a house; you want a solid structure in place before adding the finishing touches. Businesses utilize models like those provided by Vanguard, which align investments with financial objectives, timescales, and market conditions.

Benefits of Strategic Asset Allocation:

- Provides stability over the long haul.

- Helps in maintaining a focus on long-term objectives.

- Reduces anxiety during market fluctuations by sticking to a plan.

On the other end, tactical asset allocation allows for more flexibility. Think of it like a sports game where you adjust your strategy based on the opponent's movements. For instance, Invesco’s April update indicates a preference for bonds over stocks amid economic contractions. By favoring certain investments, businesses can seize opportunities in less stable markets.

Examples of Tactical Application:

- Adjusting portfolio weight towards bonds when economic indicators show contraction.

- Shifting holdings to U.S. equities during favorable market conditions to harness higher returns.

Dynamic asset allocation sits somewhere in between, frequently adjusting investments based on market performance and economic conditions. J.P. Morgan advocates for this approach, suggesting that companies remain cautious with a slight increase in recession risk while also eyeing international equities.

Now, let's take a closer look at how these models can be effectively applied. When designing a model portfolio for income, such as the one capturing a yield for annual returns, businesses can find themselves targeting specific financial outputs. For instance, a calculated investment of $106,231 could yield $10,000 annually at a 9.42% yield—a very appealing prospect for any business. This could lead to focused strategies around dividend-paying stocks or bonds that are less volatile.

Here’s a simple table to illustrate model portfolios based on various risk tolerances:

| Risk Level | Asset Mix (Equities/Bonds) | Expected Yield |

|---|---|---|

| Conservative | 30% / 70% | 4% |

| Balanced | 50% / 50% | 6% |

| Aggressive | 70% / 30% | 8% |

Finally, consider how balanced advantage funds play into this narrative. These funds dynamically adapt, making it essential for companies striving for flexibility in their investment strategies. The Edelweiss and ICICI Prudential Balanced Advantage Funds are prime examples that reflect such adaptability, potentially allowing investors to optimize returns significantly based on shifting market landscapes.

Incorporating asset allocation models not only enhances your investment strategy but also provides a structured approach to mitigate risks. As businesses, recognizing the importance of these models could be pivotal in navigating through complex market environments. With thoughtful planning and balancing of asset classes, your organization can position itself competitively, ensuring long-term profitability and stability in an unpredictable financial world.